Health Care Reforms Are a Shot in the Arm

Adjust font size:

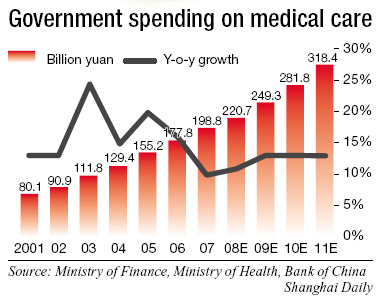

The histogram shows government spending on medical care. [Shanghai Daily]

Health care reforms in China are expected to fuel the rapid growth in the pharmaceutical industry and both domestic and multinational companies are positioning themselves to benefit from the changes, according to industry analysts.

"More than one-third of the global growth in the pharmaceutical sector in 2009 will come from emerging markets, including China, India, Mexico and Turkey," said Lin Yuechen, head of IMS China Health Market Research Consulting.

The pharmaceutical market in China expanded 26 percent last year and will continue to grow by more than 20 percent this year, the market research firm said in a report.

Minister of Health Chen Zhu told the media in Beijing early last month that a new health care insurance policy will be launched soon in the country and the reimbursement charges for essential drugs would also be raised.

"The top limit for health insurance will be raised to six times the average urban income," Chen told the China Central Television on March 5. The current limit is set at four times.

In Shanghai, 1,624 Western medicines and 1,443 Chinese patented drugs are on an essential medical list.

Insurance cover

According to the most recent version of Shanghai's medical care policies, published in March last year, an average employee aged between 35 and 44 years old will have 50 percent of medical expenses covered by insurance, after paying a deductible 1,500 yuan (US$219) incurred at a hospital or drug store.

The top limit for reimbursement for coverage is now at 70,000 yuan, a figure that varies from city to city in the country. Above that limit, an individual is required to pay 20 percent of the costs.

People can also choose to pay by using their personal accounts for ordinary non-prescription drugs at designated pharmacies. Drugs on the essential list fall into three categories, and individuals pay varying portions of the costs according to the different categories.

"The new policy will expand the domestic pharmaceutical market significantly because the new essential drug list will push drug makers to shift production in order to meet the demands of the government's program," said Luo Jing, an analyst at Shenyin and Wanguo Securities.

Minister Chen also said during the National People's Congress that 850 billion yuan will be spent in the next three years to expand the coverage of the medical and health care systems.

"The potential of China's market comes from the huge demand in suburban areas as well as the government's commitment to continue with establishing a better medical insurance system," IMS's Lin said. "Other countries currently don't have plans to boost their pharmaceutical sectors, and under adverse economic environments, they may cut medical care spending."

Joseph Jimenez, chief executive officer of Novartis Pharmaceuticals Division, told the media in Hangzhou late last month that the reform of the medical and health care system "will bring huge benefits for domestic companies, but that doesn't mean overseas firms will be shut out of the market."

Swiss-based Novartis Pharma AG is among the multinational pharmaceutical giants cutting spending in other parts of the world. It reduced 550 sales positions in the United States in October as sales there dropped 2 percent in the past year, in contrast with a 10-percent global growth rate.

The company is taking a different tack in China because it has announced that it will double its number of employees in the country in five years.

"Investing during a time of economic downturn will give us a cutting edge against our competitors at the end of the recession," Jimenez said.

Bayer HealthCare introduced Yasmin, the best selling product of its pharmaceutical subsidy Bayer Schering Pharma, into the Chinese market last month as the firm planned to expand its women health care business in China.

Big contributor

Yasmin contributed more than 13 billion yuan of sales to Bayer around the globe last year. Bayer has also announced it would invest 100 million euros (US$135 million) in China to build a global research and development center. The Beijing-based R&D center will be Bayer's fourth-largest and it will become partly operational in September this year.

The current turmoil in international financial markets is pushing pharmaceutical giants to look at mergers and acquisitions.

Following the US$68-billion purchase of Wyeth by Pfizer, Merck &Co announced on March 9 that it will acquire Schering-Plough for US$41 billion.

Lipitor, Pfizer's popular-selling cholesterol drug, contributed US$12.5 billion of sales globally to the firm in the past year, nearly one-fourth of total sales.

The patent on Lipitor is due to expire in 2011, and non-generic production of the drug by other manufacturers is expected to cut into Pfizer's earnings.

"We need to further expand our pipeline in innovative drugs and that's our strategy regarding the expiration of patent drugs," said Jimenez. "By that way we can assure profits in the future." Currently about 20 percent of Novartis Pharma's sales are allocated for R&D spending.

Novartis Pharma also sees opportunities in China's health care reforms.

"We're looking for potential partners in China's generic drug industry so that we can get into the business more quickly," Jimenez said.

Lin said many multinational pharmaceutical companies are turning their focus to other regions in China and smaller cities because they see the markets as untapped.

Domestic pharmaceutical companies are also seeking opportunities to expand.

CNTIC Trading Co, the pharmaceutical subsidy of China General Technology (Group) Holding Ltd, announced on March 12 that it would acquire Beijing Holley Pharmaceutical Co for 80 million yuan.

The acquisition will strengthen CNITC's sales network, which includes Beijing and Guangzhou, and the company will expand its operations in the over-the-counter market.

Shanghai Pharmaceutical Co, China's second-largest pharmaceutical distributor, in December announced it would increase its stake in its subsidiary, Huashi Pharmacy Co, to 92.02 percent as the firm is seeking to strengthen its retail sales network.

"The government's new medical care policies will accelerate the focus on the domestic pharmaceutical business and that will help Shanghai Pharmaceutical increase its profit," Qu Yi, an analyst at Donghai Securities, wrote in a recent research report.

(Shanghai Daily April 6, 2009)